Coronavirus (COVID-19) Current Therapy Market In 2029

The Business Research Company’s Coronavirus (COVID-19) Current Therapy Global Market Report 2025 – Market Size, Trends, And Forecast 2025-2034

LONDON, GREATER LONDON, UNITED KINGDOM, December 19, 2025 /EINPresswire.com/ -- Coronavirus (COVID-19) Current Therapy Market to Surpass $0.5 billion in 2029. Within the broader Healthcare Services industry, which is expected to be $10,759.4 billion by 2029, the Coronavirus (COVID-19) Current Therapy market is estimated to account for nearly 0.005% of the total market value.

Which Will Be the Biggest Region in the Coronavirus (COVID-19) Current Therapy Market in 2029

North America will be the largest region in the coronavirus (COVID-19) current therapy market in 2029, valued at $391 million. The market is expected to decline from $5,099 million in 2024 at a compound annual growth rate (CAGR) of -40%. The declined growth can be attributed to widespread vaccine availability, declining hospitalizations, and a shift in government policies toward managing COVID-19 as an endemic condition. Decreased funding for COVID-19 therapy programs also played a role.

Which Will Be The Largest Country In The Global Coronavirus (COVID-19) Current Therapy Market In 2029?

The USA will be the largest country in the coronavirus (COVID-19) current therapy market in 2029, valued at $355 million. The market is expected to decline from $4,477 million in 2024 at a compound annual growth rate (CAGR) of -40%. The declined growth can be attributed to the widespread rollout of vaccines, improved treatment protocols, and a reduction in the number of severe cases.

Request a free sample of the Coronavirus (COVID-19) Current Therapy Market report:

https://www.thebusinessresearchcompany.com/sample_request?id=6183&type=smp

What will be Largest Segment in the Coronavirus (COVID-19) Current Therapy Market in 2029?

The coronavirus (COVID-19) current therapy market is segmented by drug type into antivirals, monoclonal antibodies (Mabs), corticosteroid, supplements, antimalarial, interferons and interleukin inhibitors, other anti-infections and others. The monoclonal antibodies (Mabs) market will be the largest segment of the coronavirus (COVID-19) current therapy market segmented by drug type, accounting for 38% or $192 million of the total in 2029. The monoclonal antibodies (Mabs) market will be supported by the increasing demand for effective treatments, the approval of antiviral drugs like Paxlovid, Remdesivir and Molnupiravir, the development of new antiviral agents, ongoing clinical trials, the emergence of viral mutations, regulatory approvals, global distribution challenges, affordability and accessibility concerns and the need for rapid treatment options for high-risk populations.

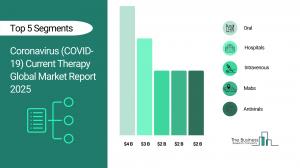

The coronavirus (COVID-19) current therapy global market is segmented by route of administration into oral and intravenous. The oral market will be the largest segment of the coronavirus (COVID-19) current therapy market segmented by route of administration, accounting for 57% or $285 million of the total in 2029. The oral market will be supported by increasing demand for convenient and easy-to-administer treatments, the approval of oral antivirals like Paxlovid and Molnupiravir, the development of new oral therapies to treat mild to moderate COVID-19, the advantages of oral treatments in terms of accessibility and patient compliance, the need for rapid treatment options to reduce hospitalization rates, ongoing clinical trials to assess efficacy and safety, the potential for oral therapies to be used in combination with other treatments

The coronavirus (COVID-19) current therapy market is segmented by end-user into hospitals, clinics, home care and other end-users. The hospitals market will be the largest segment of the coronavirus (COVID-19) current therapy market segmented by end-user, accounting for 63% or $313 million of the total in 2029. The hospitals market will be supported by the increasing demand for critical care treatments, the administration of antiviral, monoclonal antibody, corticosteroid and intravenous therapies in severe and critical COVID-19 cases, the capacity and infrastructure challenges faced by hospitals during peak infection periods, the need for specialized medical staff and resources for intensive care unit (ICU) management, the integration of COVID-19 treatments into hospital protocols and care pathways, the influence of government and regulatory guidelines on treatment options, the rising cost of hospitalization due to extended ICU stays and the ongoing focus on improving patient outcomes through rapid diagnosis, monitoring and personalized care for aged people.

What is the expected CAGR for the Coronavirus (COVID-19) Current Therapy Market leading up to 2029?

The expected CAGR for the coronavirus (COVID-19) current therapy market leading up to 2029 is -43%.

What Will Be The Growth Driving Factors In The Global Coronavirus (COVID-19) Current Therapy Market In The Forecast Period?

The rapid growth of the global coronavirus (COVID-19) current therapy market leading up to 2029 will be driven by the following key factors that are expected to reshape healthcare delivery and treatment protocols worldwide.

Rising Prevalence Of Chronic Diseases- The rising prevalence of chronic diseases will become a key driver of growth in the coronavirus (COVID-19) current therapy market by 2029. Chronic conditions such as diabetes, cardiovascular diseases and respiratory disorders compromise the immune system, increasing the risk of severe COVID-19 outcomes. As the prevalence of these chronic conditions continues to rise, there is a growing need for effective therapies that can address the unique challenges faced by at-risk populations. As a result, the rising prevalence of chronic diseases is anticipated to contributing to annual growth in the market.

Increasing Aging Population- The increasing aging population will emerge as a major factor driving the expansion of the market by 2029. Older adults are particularly vulnerable to severe complications from COVID-19, primarily due to weakened immune systems, the presence of comorbidities and heightened risk factors such as chronic conditions. As the aging population continues to grow, the demand for effective COVID-19 therapies, including antiviral treatments, vaccines and supportive care, is expected to increase. Older populations typically require a greater level of healthcare resources, including hospitalizations and outpatient care, due to their higher prevalence of chronic conditions and related health challenges. Consequently, the increasing aging population is projected to contributing to annual growth in the market.

Increase In Healthcare Expenditure- The increase in healthcare expenditure will serve as a key growth catalyst for the market by 2029. Increased healthcare expenditures enhance the availability of financial resources for research and development (R&D) of new treatments and therapies for COVID-19. This facilitates investment in innovative drug development, clinical trials and testing, leading to the advancement of more effective therapies. Additionally, higher healthcare budgets often drive the adoption of digital health solutions, such as telemedicine platforms and patient management systems. These technologies enhance the efficiency of COVID-19 therapy delivery, support remote patient monitoring and ensure timely access to care. Therefore, increase in healthcare expenditure is projected to supporting to annual growth in the market.

Favorable Government Initiatives- The favorable government initiatives will become a significant driver contributing to the growth of the market by 2029. Governments allocate financial resources or grants to support research, development and manufacturing of COVID-19 therapies, including antiviral drugs and other treatment solutions. This helps reduce entry barriers for pharmaceutical companies, thereby accelerating innovation. Consequently, the favorable government initiatives is projected to contributing to annual growth in the market..

Access the detailed Coronavirus (COVID-19) Current Therapy Market report here:

https://www.thebusinessresearchcompany.com/report/coronavirus-covid-19-current-therapy-market

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. We have published over 17,500 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package and much more.

Disclaimer: Please note that the findings, conclusions and recommendations that TBRC Business Research Pvt Ltd delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such TBRC Business Research Pvt Ltd can accept no liability whatever for actions taken based on any information that may subsequently prove to be incorrect. Analysis and findings included in TBRC reports and presentations are our estimates, opinions and are not intended as statements of fact or investment guidance.

Contact Us:

The Business Research Company

Americas +1 310-496-7795

Europe +44 7882 955267

Asia & Others +44 7882 955267 & +91 8897263534

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Oliver Guirdham

The Business Research Company

+44 7882 955267

info@tbrc.info

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.