Insurance Third-Party Administrators (TPAs) Market In 2029

The Business Research Company's Insurance Third-Party Administrators (TPAs) Global Market Report 2025 – Market Size, Trends, And Global Forecast 2025-2034

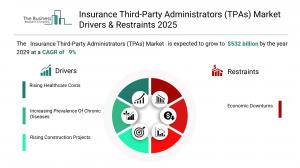

LONDON, GREATER LONDON, UNITED KINGDOM, December 19, 2025 /EINPresswire.com/ -- "Insurance Third-Party Administrators (TPAs) Market to Surpass $532 billion in 2029. Within the broader Financial Services industry, which is expected to be $47,553 billion by 2029, the Insurance Third-Party Administrators (TPAs) market is estimated to account for nearly 1% of the total market value.

Which Will Be the Biggest Region in the Insurance Third-Party Administrators (TPAs) Market in 2029

North America will be the largest region in the insurance third-party administrators (TPAs) market in 2029, valued at $227,017 million. The market is expected to grow from $154,029 million in 2024 at a compound annual growth rate (CAGR) of 8%. The strong growth can be attributed to the rising emphasis on fraud detection and the rise of digitalization.

Which Will Be The Largest Country In The Global insurance Third-Party Administrators (TPAs) Market In 2029?

The USA will be the largest country in the insurance third-party administrators (TPAs) market in 2029, valued at $214,665 million. The market is expected to grow from $145,703 million in 2024 at a compound annual growth rate (CAGR) of 8%. The strong growth can be attributed to the increasing complexity of insurance claims and the increasing prevalence of chronic diseases.

Request a free sample of the Insurance Third-Party Administrators (TPAs) Market report:

https://www.thebusinessresearchcompany.com/sample_request?id=18644&type=smp

What will be Largest Segment in the Insurance Third-Party Administrators (TPAs) Market in 2029?

The insurance third-party administrators (TPAs) market is segmented by type into health plan administrators, third-party claims administration, and worker’s compensation third-party claims administration (TPA). The health plan administrators market will be the largest segment of the insurance third-party administrators (TPAs) market, segmented by type, accounting for 52% or $275,762 million of the total in 2029. The health plan administrators market will be supported by rising demand for efficient claims management, the growing prevalence of chronic diseases, the need for cost containment in healthcare, and increasing healthcare costs.

The insurance third-party administrators (TPAs) market is segmented by service into claims management, policy management, and commission management. The claims management market will be the largest segment of the insurance third-party administrators (TPAs) global market, segmented by service, accounting for 57% or $304,644 million of the total in 2029. The claims management market will be supported by the increasing volume of healthcare claims due to rising medical expenses, the adoption of digital solutions for efficient claims processing, advancements in artificial intelligence and automation technologies, and the growing demand for fraud detection and prevention.

The insurance third-party administrators (TPAs) market is segmented by enterprise size into large enterprises and small and medium-sized enterprises. The large enterprises market will be the largest segment of the insurance third-party administrators (TPAs) market, segmented by enterprise size, accounting for 65% or $346,441 million of the total in 2029. The large enterprises market will be supported by the increasing complexity of healthcare plans, the need for scalable administrative solutions, the growing demand for customized health plan services to manage large employee bases efficiently, and advancements in technologies, such as AI and data analytics.

The insurance third-party administrators (TPAs) market is segmented by application into healthcare, construction, real estate and hospitality, transportation, and staffing. The healthcare market will be the largest segment of the insurance third-party administrators (TPAs) market, segmented by application, accounting for 54% or $285,164 million of the total in 2029. The healthcare market will be supported by the growing demand for healthcare services, increasing healthcare costs, the expansion of health insurance coverage, advancements in healthcare technology, and the rising prevalence of chronic diseases

The insurance third-party administrators (TPAs) market is segmented by end-user into life and health insurance and property and casualty insurance. The life and health insurance market will be the largest segment of the insurance third-party administrators (TPAs) global market, segmented by end-user, accounting for 58% or $309,075 million of the total in 2029. The life and health insurance market will be supported by the increasing prevalence of chronic diseases, the rising demand for comprehensive health coverage, advancements in medical treatments and healthcare technologies, and the growing aging population.

What is the expected CAGR for the Insurance Third-Party Administrators (TPAs) Market leading up to 2029?

The expected CAGR for the insurance third-party administrators (TPAs) market leading up to 2029 is 9%.

What Will Be The Growth Driving Factors In The Global Insurance Third-Party Administrators (TPAs) Market In The Forecast Period?

The rapid growth of the global insurance third-party administrators (TPAs) market leading up to 2029 will be driven by the following key factors that are expected to reshape claims management, cost containment, customer experience, regulatory compliance, and insurer–provider relationships worldwide.

Rising Healthcare Costs- The rising healthcare costs will become a key driver of growth in the insurance third-party administrators (TPAs) market by 2029. With the increasing cost of healthcare, efficient claims processing is essential for insurers and employers to control expenses effectively. Third-party administrators (TPAs) specialize in streamlining and automating claims, reducing delays and ensuring timely payments. As healthcare costs continue to rise, organizations are seeking ways to manage these expenses more efficiently. TPAs serve as intermediaries, assisting insurance providers and employers in administering healthcare plans. They offer services such as claims processing, network management and compliance oversight, helping organizations minimize administrative costs and improve operational efficiency. As a result, the rising healthcare costs is anticipated to contributing to annual growth in the market.

Increasing Prevalence Of Chronic Diseases- The increasing prevalence of chronic diseases will emerge as a major factor driving the expansion of the insurance third-party administrators (TPAs) market by 2029. Chronic diseases necessitate prolonged medical care, including frequent doctor visits, medications and specialized treatments, contributing to rising healthcare costs. To manage these increasing expenses, insurance companies often outsource key functions such as claims processing, customer service and network management to third-party administrators (TPAs). TPAs play a vital role in cost containment through risk management, enhancing healthcare delivery, and streamlining the claims process to improve efficiency. Consequently, the increasing prevalence of chronic diseases is projected to contributing to annual growth in the market.

Rising Construction Projects- The rising construction projects will serve as a key growth catalyst for the insurance third-party administrators (TPAs) market by 2029. With increased construction activity, the demand for comprehensive insurance coverage has risen to safeguard against risks such as property damage, equipment failures, liability and worker injuries. Construction projects often require various types of insurance, including general liability, workers' compensation and property insurance. Third-party administrators (TPAs) play a key role in managing these policies, handling claims processing, performing administrative tasks and ensuring compliance with insurance regulations. Therefore, this rise in construction projects is projected to supporting to annual growth in the market.

Economic Growth- The economic growth will become a significant driver contributing to the growth of the insurance third-party administrators (TPAs) market by 2029. Economic growth enables individuals and businesses to access insurance products like health, life and property coverage. This growth fosters the adoption of digital and technological advancements, including automation, artificial intelligence and data analytics. Third-party administrators (TPAs) utilize these technologies to enhance operational efficiency, minimize costs and improve service delivery across insurance products. By leveraging automation and data analytics, TPAs can streamline processes, reduce administrative burdens and deliver faster, more accurate solutions, ultimately enhancing the overall customer experience. Consequently, the economic growth is projected to contributing to annual growth in the market.

Rise Of Digitalization- The rise of digitalization will become a significant driver contributing to the growth of the insurance third-party administrators (TPAs) market by 2029. Digitalization is driving the automation of critical processes such as claims processing, underwriting and policy management for insurance TPAs. By leveraging AI and machine learning, TPAs can enhance operational efficiency, reduce manual efforts and accelerate claim processing times, resulting in improved accuracy and faster service delivery. Digital solutions empower TPAs to collect, store and analyze vast amounts of data more effectively, leading to better risk assessment, underwriting accuracy and pricing decisions. Consequently, the rise of digitalization is projected to contributing to annual growth in the market.

Access the detailed Insurance Third-Party Administrators (TPAs) report here:

https://www.thebusinessresearchcompany.com/report/insurance-third-party-administrators-global-market-report

What Are The Key Growth Opportunities In The Insurance Third-Party Administrators (TPAs) Market in 2029?

The most significant growth opportunities are anticipated in the insurance TPA for claims management market, the life and health insurance TPA market, the large enterprise insurance TPA market, the insurance third-party administration (TPA) for health plan market, and the integrated healthcare insurance TPA market. Collectively, these segments are projected to contribute over $550 billion in market value by 2029, driven by the increasing outsourcing of administrative functions to improve operational efficiency, the rising complexity of insurance claims and compliance requirements, and the growing demand for digital platforms that streamline benefits coordination and claims management. This surge reflects the accelerating adoption of advanced analytics, automation, and cloud-based solutions that enable faster processing, reduced administrative burdens, and improved customer experience, fueling transformative growth within the broader insurance administration and benefits management ecosystem.

The insurance TPA for claims management market is projected to grow by $117,522 million, the life and health insurance TPA market by $114,843 million, the large enterprise insurance TPA market by $107,462 million, the insurance third-party administration (TPA) for health plan market by $105,513 million, and the integrated healthcare insurance TPA market by $105,266 million over the next five years from 2024 to 2029.

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. We have published over 17,500 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package and much more.

Disclaimer: Please note that the findings, conclusions and recommendations that TBRC Business Research Pvt Ltd delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such TBRC Business Research Pvt Ltd can accept no liability whatever for actions taken based on any information that may subsequently prove to be incorrect. Analysis and findings included in TBRC reports and presentations are our estimates, opinions and are not intended as statements of fact or investment guidance.

Contact Us:

The Business Research Company

Americas +1 310-496-7795

Europe +44 7882 955267

Asia & Others +44 7882 955267 & +91 8897263534

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company"

Oliver Guirdham

The Business Research Company

+44 7882 955267

info@tbrc.info

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.